|

|

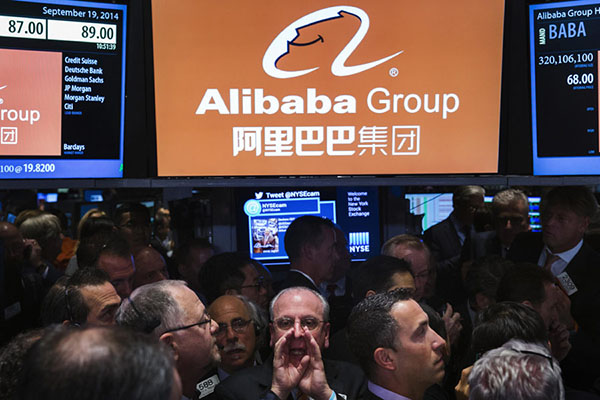

Traders work on the floor as they wait for a final price on the Alibaba Group Holding Ltd. initial public offering (IPO) under the ticker "BABA", at the New York Stock Exchange in New York Sept 19, 2014. [Photo/Agencies] |

Chinese tech firms have fallen out of love with America, and it shows - a growing number of them are looking to drop their listings in New York and head back home.

Many Chinese tech executives are betting on higher share valuations in China where stock markets have recently caught fire. They also hope to evade any legal mess when Beijing formally outlaws foreign shareholder control of firms in protected tech sectors.

An exodus of Chinese tech firms would spell the end of a profitable line of business for Wall Street underwriters. Last year, the $25 billion IPO of e-commerce giant Alibaba - the world's largest initial public offering ever - generated more than $300 million in fees.

The numbers are hard to resist. China's tech-driven ChiNext composite index has gained nearly 180 percent this year, eclipsing the 30 percent rise in the Nasdaq OMX China Technology Index that tracks offshore listed mainland firms.

Firms listed on the Nasdaq index get an average share price equal to 11 times their earnings. On ChiNext, they get 133 times. There's a debate over which ratio is more accurate, but Chinese executives blame US ignorance of China.

"American investors don't understand the business model of Chinese gaming companies," said a senior executive of one such firm planning to eject from New York and move back to a Chinese listing, speaking on condition of anonymity.

Earlier this year, New York-listed Chinese gaming firms Shanda and Perfect World said they would go private, while online dating service Jianyuan.com and medical R&D services provider Wuxi Pharmatech said they are thinking about it.

Analysts expect dozens of lesser-known companies to follow if they can, and they see the pipeline of Chinese companies trying to list in New York drying up.

"The possibility of stirring interest among US investors is slim," said Shu Yi, CEO of Beijing-based advertising technology company Limei Technology, which recently gave up on plans to list in New York and now is hoping to IPO in Shanghai or Shenzhen.

On Thursday, Chinese Premier Li Keqiang encouraged more of such companies to return, particularly those with "special ownership structures," referring to the contractual loopholes employed by many Chinese firms to evade restrictions on foreign ownership.

China is lining up the finances to assist the repatriation. Investment bank China Renaissance has teamed up with Citic Securities to raise funds to help delist and underwrite new listings in China, while Shengjing Management Consulting has launched a fund-of-funds that intends to repatriate about 100 Chinese firms.