Growth for all seasons is the target

Updated: 2014-05-02 09:24

By Zheng Yanpeng (China Daily Africa)

Comments Print Mail Large Medium Small

|

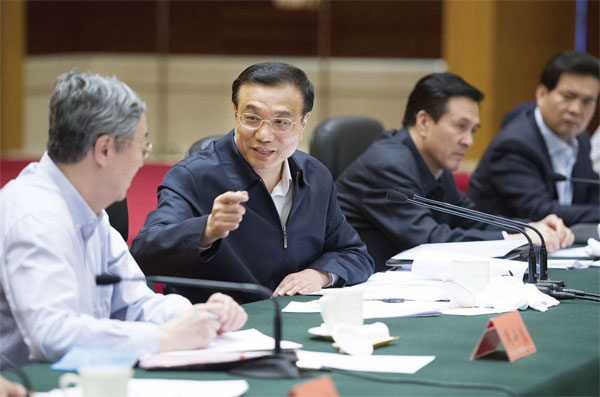

Chinese Premier Li Keqiang (second from left) presides over a seminar on economic development in Shenyang, capital of northeastern Liaoning province, on March 26. Huang Jingwen / Xinhua |

Li's push aims to find viable solutions for China's long-term problems

At a news conference that was broadcast worldwide in March, a US journalist asked Chinese Premier Li Keqiang what he thought would be a comfortable growth rate for China.

"Without any short-term stimulus program, we ended up with a growth rate above the official target last year. Why can't we achieve it this year also?" was the response from the premier.

Li is no stranger to such questions. As the first trained economist to be premier, Li has often been besieged with questions on China's desirable growth rate and the ceiling for the government to roll out stimulus programs.

Last July, when GDP growth in China fell to 7.5 percent in the second quarter, the floor set by the government, Li faced mounting pressure from all quarters to unshackle monetary and fiscal policies to stimulate growth.

Though Li did react, the intensity of his response was not what many had expected. Rather than go in for drastic policy measures, the premier unveiled a series of measures to ease the financing burden for small firms.

Starting from Aug 1, small companies with monthly revenue of less than 20,000 yuan ($3,200) were exempted from paying value-added tax and business tax. Those measures paid off as economic growth rebounded in the third quarter, and demand for further stimulus measures petered out.

History, however, seemed to be catching up with the premier when China's economic growth slowed to 7.4 percent in the first quarter of 2014. This was the slowest expansion since the first quarter of 2009 and on par with that of the third quarter of 2012.

Once again, Li found himself being pressed for more fiscal and monetary measures to alleviate the business burden. Like last year, rather than opt for stimulus measures, the government has instead decided to choose a pragmatic approach and address the problems at the grass-roots level.

Reiterating that economic growth in China is still within "the reasonable range", the State Council unveiled several growth initiatives, including tax breaks for small and micro enterprises, greater support for the redevelopment of run-down urban areas and more investment in railways.

Though these measures have disappointed those who had expected massive stimulus programs focused on infrastructure construction, the thinking within the government seems to be more centered on creating a level-playing field for overseas and private investors.

On April 23, the State Council made its intentions clear when it indicated that it would give wider access to private and overseas investors in more than 80 infrastructure projects that had hitherto been dominated by state-owned enterprises.

Though these actions have been termed as cautionary steps by some economists, others consider them to be bold, decisive steps that will pay off in the long run.

Fan Jianping, chief economist with the State Information Center, a government think-tank, believes that it is high time that domestic and overseas economists discard their outdated perspectives about China.

Fan says that most of the experts had expected China to ease monetary policy and unveil more fiscal measures to pump-prime the economy. But instead the new leadership decided to pursue the reform agenda by alleviating the tax burden on small firms, cut red tape and boost private investment to lift long-term growth prospects.

"The traditional methods are like antibiotics: quick results, but with more side effects. The reform measures are more like traditional Chinese medicine: fewer side effects but slower results," says Xie Yaxuan, head of macroeconomic research with the Shenzhen-based China Merchants Securities.

Fan says that a prominent feature of the macroeconomic policy under Premier Li is the close link between growth measures, reforms and efforts to improve people's livelihoods. For example, to spur enthusiasm for entrepreneurship, the government has since last year scrapped many of the registration requirements for startups. As a result, the number of newly registered businesses rose 27.6 percent in 2013, compared with just 1 or 2 percent in the previous years.

Realizing that the onerous administrative approval process had hindered business growth, Li delegated or canceled 334 such items last year, and vowed to cut at least another 200 this year.

A closer examination of the 38 State Council executive meetings held in the past year show that of the more than 100 topics discussed, at least 30 were related to the reform of government machinery.

"The essence of Likonomics is more about state restraint than state action. Its basic characteristics are empowering the market, loosening controls and improving market supply," says Guan Qingyou, assistant dean of the Minsheng Securities Research Institute.

Shen Jianguang, chief Asia economist at Mizuho Securities Asia Ltd, also agrees with this assessment. "Likonomics resembles supply-side economics. It is different from monetarism, or adjusting money supply and interest rates, and Keynesianism, of using government spending to increase demand and stimulate production. Likonomics' major pillar is to improve the production pricing system, ease restraint on market access and push forward further reforms."

In this regard, Fan said it is illusory to expect the government to launch Keynesian stimulus packages in the coming months. "They underestimate Li's resolve," he says.

Premier Li's economic strategies are also an indication that China's growth will bail out the sagging global economy. But given the current size of China's economy, and the 7-8 percent growth rate, it also indicates that there are still several growth opportunities.

According to Capital Economics, a London-based research firm, China added 5 trillion yuan ($800 billion) to its GDP in 2013, only slightly less than in 2007, when the economy grew by 13 percent. The 19 percent increase in China's iron-ore imports in the first quarter was double the increase of a decade ago, when imports were rising at about 50 percent a year.

The world should also not overlook another dimension of Li's economic strategy: enhancing growth prospects by further integrating into the global economy.

One of the signature projects engineered by Li in this area is the launch of the Shanghai Free Trade Zone last year. The three main objectives of the FTZ are trade liberalization, investment facilitation and financial liberalization. The experiment will soon be extended to other areas also.

Long Yongtu, former vice-minister of commerce, said in an April forum that the Shanghai FTZ is closely linked to China's commitment to further opening to the world. It will be a test ground for China to make up its mind about embracing higher-standard trade and investment agreements. These include the strategically important US-China Bilateral Investment Treaty, the EU-China BIT and the Regional Comprehensive Economic Partnership that are in various stages of negotiations.

Li's liberal stance on foreign trade and investment has been further accentuated by his attitude toward the Trans-Pacific Partnership, a US-led high-standard pact. Since last year, Li has helped to dispel domestic suspicion that TPP is a pact deliberately designed to alienate China. At this year's Boao Forum for Asia, he again expressed his openness to the TPP.

"As long as it is conductive to world trade, and to an equitable and open trade environment, China would like to see the pact progress," Li said.