Liquidity crush props up offshore yuan

Updated: 2016-12-29 08:53

By luo weiteng in Hong Kong(HK Edition)

|

|||||||||

Chinese currency's borrowing cost in SAR hits new high

The offshore yuan's borrowing cost in Hong Kong hit a fresh high on Wednesday, reflecting an intensified liquidity squeeze as the Chinese mainland's central bank tightens its grip on the weakening currency.

The overnight Hong Kong Interbank Offered Rate of the yuan soared 8.6 percentage points to fix at 15.18 percent - its biggest gain since September.

Amid muted trading sessions ahead of the year-end holiday break, the yuan remained flat against the US dollar. But analysts believed that the depreciation pressure on the renminbi is poised to extend into next year, making 2017 another fluctuating year for the currency.

The offshore yuan in the SAR edged down 0.18 percent to 6.9705 against the US dollar as of 6:25 pm on Wednesday, making the spot yuan on track to post a year-round loss of more than 6 percent against the greenback.

Meanwhile, the People's Bank of China set the midpoint rate at 6.9495 per US dollar prior to the market opening - weaker than the previous fix of 6.9462.

This resulted in the onshore yuan being 0.1 percent weaker at 6.9585 per US dollar as of 6:25 pm in Shanghai, putting the currency in the spot market on course to finish the year with a loss of more than 7.1 percent against the greenback.

"The yuan will remain on a depreciation path in 2017, with capital outflows persisting due to structural factors like asset diversification, cyclical drivers like growth and yield differentials, as well as waning confidence in the currency," said a report from HSBC. "These outflow pressures will become more acute if the strong dollar environment persists."

A cluster of monetary tightening policies, in a sign of the country's determination to curb capital outflows, has been attributed to the yuan's surging borrowing cost in the onshore market.

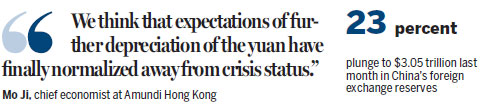

Foreign exchange reserves in the world's second-largest economy plunged more than 23 percent from a peak of nearly $4 trillion two years ago to $3.05 trillion last month. This stands in sharp contrast to the 32-percent growth of foreign currency bank deposits owned by mainland households in the first 11 months of the year, indicating that the capital exodus is a real issue for the nation.

"Volatility in the yuan could thus be higher than usual in the first quarter of 2017, as the market digests the impact on the dollar from the new economic policies of the incoming US administration," HSBC noted.

Yi Xianrong, a Qingdao University professor and former Chinese Academy of Social Sciences researcher, agreed with the projection, joining the chorus of apprehension over the yuan's continued depreciation in the coming year.

Factors such as the faster-than-expected monetary tightening path in the US and an exchange of tense rhetoric on the yuan's exchange rate between the US and China, that could lead to a serious trade conflict between the two countries, are likely to exert fresh downward pressures on the Chinese currency, he said.

Mo Ji, chief economist at Amundi Hong Kong, however, believed that the yuan will be a currency stabilizer in 2017 - a phenomenon that's still underestimated by the market.

"We think that expectations of further depreciation of the yuan have finally normalized away from crisis status," he said.

With the greenback having gained much strength by appreciating more than 3 percent since Donald Trump's upset election win, the yuan has weathered the shock nicely by depreciating just 1.4 percent, implying the relative hidden strength in the currency, Mo observed.

"China is contributing stability to the world economy and markets both in economic and currency terms in 2017. Looking ahead, the larger and more open the Chinese economy becomes, compared to the closed off and smaller US economy, relatively speaking at least, it will rewrite everything we currently know," he added.

sophia@chinadailyhk.com

(HK Edition 12/29/2016 page1)