Reverse psychology

Updated: 2013-09-06 06:46

By Li Tao(HK Edition)

|

|||||||||

HK's elderly can enhance retirement lifestyles by unlocking the equity in their homes with a reverse-mortgage loan. At least, that's the theory. Li Tao reports.

At last, a ray of hope for the city's senior citizens, with the administration's about face, ending its longstanding opposition to reverse mortgage. It's a concept that's catching on, as Hong Kong seniors come to realize the program is a means of providing a secure income during their retirement. The Mandatory Provident Fund Schemes (MPF) established in December 2000 was supposed to have provided the solution but it didn't work. Individual contributions are small and with 13 percent of the population already over 65, the total proceeds of the MPF don't add up to much.

Just to give older people the chance to live out their lives with dignity, something had to be done. But there's never been an easy fix.

By the middle of last year, the city's median age had risen to 42 - which may not seem very serious, until one stops to contemplate that the median age was 20, back in 1966. Way back then, only 3.3 percent of Hong Kong's people were over 65. Consider the future prospect, when, by 2036, more than a quarter of the city's population - 26.4 percent will be over 65. Who's going to take care of them? There aren't enough babies being born.

In 2011, the city's fertility rate was 1.2 children (1.2 children born to women in their child bearing years). It has to be 2.1 just to keep the population stable. At a fertility rate of 1.2 there would be a catastrophic decline in population without substantial emigration to the city.

Reverse mortgages have been giving financial support to seniors for years - just not in Hong Kong. It took years of soul searching and debate before the Hong Kong government finally decided to allow reverse mortgages. In July 2011, when the government-backed Hong Kong Mortgage Corporation (HKMC) launched the reverse-mortgage program, seven local banks attended the signing ceremony.

Under Hong Kong's reverse-mortgage scheme, a homeowner over 60, can put up his home as collateral for a fixed bank loan, paid to him every month for five, 10, 15 and 20 years, or even for life. The owner can even take out loans for making lump sum payments. The payments keep coming so long as the owner lives in the residence and his loans don't exceed the value of his equity. When he dies, title to the property goes to the bank, and remaining equity after the value of all the loans is subtracted, is paid to the owner's estate. If there's a shortfall in equity, HKMC will pay the difference to the bank.

In November 2012, just a year after the commencement of reverse mortgages, HKMC increased the maximum allowable property value on which the mortgages could be based from HK$8 million ($1.03 million) to HK$15 million. The age threshold for eligibility was lowered to allow homeowners over 55 to avail the reverse-mortgage program.

Inevitably, given the city's serious aging problem, the government is being pressured by force of circumstance to seek every possible solution, or else a growing number of retirees will become dependent on support from a diminishing labor pool.

Old and poor

The Census and Statistics Department forecasts that the elderly dependency ratio in Hong Kong - the number of retired persons, aged 65 or above relative to the working age population, between 15 and 64 - will grow increasingly unfavorable, from 1 to 5.6, today, to 1 to 2 in less than thirty years. The city's elderly will account for nearly a third of Hong Kong's adult population.

The chilling reality behind the cold statistics is that elderly people are the poorest, most disadvantaged group in the city. The Hong Kong Council of Social Service noted in August, that it's a global issue. Nearly one-third of people aged 65 and over are classified as poor. In Hong Kong, that means their earnings are equal to less than half of the city's median monthly household income.

"In light of the aging population in Hong Kong, retirement financial planning is becoming more important," HKMC tells China Daily in a written e-mail reply. "Reverse mortgages provide an alternative for elderly homeowners to release equity locked up in their properties and hence, receive steady cash flows to improve their quality of life, while staying in their own homes during their lifetime."

The amount of a borrower's monthly payout will depend on the value of his property and the age at which he signed on to the reverse- mortgage scheme. Once the monthly payout is determined, it remains unchanged throughout the term of payment, regardless of any future shifts in property values and interest rates, inflation or deflation, or other economic factors.

Earlier this year, HKMC's Chief Executive Officer Raymond Li recommended that eligible applicants consider reverse mortgages. Under the scheme seniors are likely to qualify for higher monthly payments with the property market as buoyant as it has been.

Even if transactions shrank notably this year due to government measures to cap the city's property market, Hong Kong's home prices today are still more than double what they were in early 2009, because of record-low interest rates and a lack of new homes coming onto the market.

"I will definitely join the program in the future," Li said during an interview with a local newspaper. The stereotype that parents leave their properties to their children in Hong Kong, must change, because it's become unnecessary at a time when the kids are leading good lives. On the other hand, even if the younger generations are living under financial constraints, the reverse-mortgage scheme that could pay the rest of the lives of the elderly will also release part of the financial burdens on their children, according to Li.

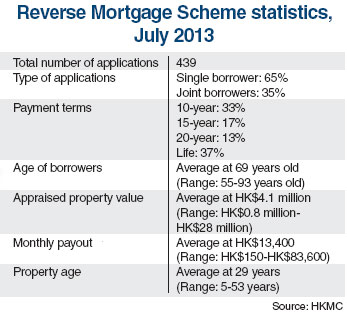

Since the launch of the program, HKMC has received a total of 439 applications as of the end of July this year, among which 65 percent are joint borrowers. The rest are single borrowers. Only 37 percent of borrowers choose the lifetime payment term while the others opt to receive monthly payouts over a fixed period of 10, 15, as well as 20 years.

HKMC data also showed that the average age of borrowers under the program has reached 69. The average appraised property value was HK$4.1 million with monthly payouts averaging HK$13,400.

Longest living

Hong Kong people are among the longest-living in the world. Life expectancy in the city was 86.3 years for females born in 2012 and 80.6 years for males. At the same time, the median monthly income for men was HK$13,000 in 2011, while women's incomes were lower at HK$11,000 per month, said the Census and Statistics Department.

By the end of March 2012, the total number of private residences in Hong Kong was 1.4 million, according to government data. Since over a half of the private homes have either paid up mortgages or are fully owned, the 439 applications for reverse mortgages up to July 2013, by comparison, reflects an exceptionally small proportion of private housing in Hong Kong.

The lukewarm response to reverse mortgages in Hong Kong reflects the deep-rooted conviction that properties remain the most reliable assets, says John Siu, executive director of Cushman & Wakefield (Hong Kong).

"Rich families won't bother to participate in the program to receive cash, and poor ones, whose apartments could be the only valuable asset they have in hand, may also struggle to surrender their homes, rather than leaving them to the next generation," Siu says.

Unfavorable discounts on the valuations of properties could be another reason people are less interested in the program.

One example, posted on the HKMC website, based on a property valued at HK$1 million dollars showed that a 55-year-old borrower would receive a payout of HK$3,200 per month, over a ten year term; a 70-year-old borrower would receive HK$5,100 per month.

The total payout over the decade would be a mere HK$384,000 for the 55-year-old and HK$612,000, for the 70-year-old, huge discounts on the current value of the property.

No interest in reverse

A research report titled "Housing for the elderly in Hong Kong - affordability and preferences", published by The Hong Kong Polytechnic University in August 2012 indicated that 72.9 percent of the 303 respondents indicated they had no interest in acquiring a reverse mortgage.

A significant number of respondents said they regarded the payout based on their property values as "not enough for their daily expenditure", believing that "their assets in cash or savings were enough to cover their daily expenditure."

The survey also showed that bequests factor heavily into the decision to take out a reverse mortgage. Respondents with no children showed greater willingness to join the program than those with children.

"The concept is still new to Hong Kong people even if it has been adopted in some countries for quite a while. It takes time for people to understand the rules and eventually accept the idea," Siu adds.

HKMC also reminded that the costs incurred by a borrower for taking out a reverse-mortgage loan mainly consist of the initial set-up, such as interest cost, mortgage insurance premium, counseling fees and other handling fees, which can however, be financed to the reverse-mortgage loan.

And there are ongoing obligations for the borrower to observe after taking out a reverse-mortgage loan, said HKMC. The borrower is still the owner of the property and continues to be responsible for all ongoing expenses on the property such as management fees, government rents, rates and maintenance costs.

There is also a requirement that borrowers have to make a declaration on an annual basis to confirm that they still use the property as their principal residence in Hong Kong.

Contact the writer at litao@chinadailyhk.com

(HK Edition 09/06/2013 page5)