Businesses seek refuge in bond funds

Updated: 2013-01-09 07:00

By Sophie He(HK Edition)

|

|||||||||

|

Former Hong Kong Monetary Authority Chief Executive Joseph Yam speaks at a global bonds conference in Hong Kong (file photo). Bond funds surged in 2012 as city's investors turned to bonds for profit. Paul Hilton / Bloomberg |

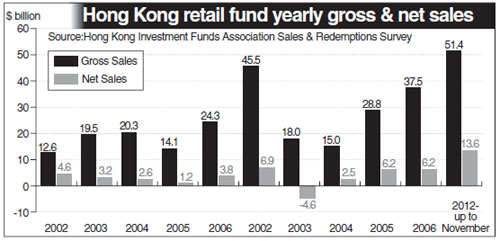

The gross sales of retail investment funds in Hong Kong surged 42 percent to a record $51.4 billion in the first 11 months of 2012 as thirst for interest income amid the low interest rate environment and heightened risk aversion drove more investors into investing in bond funds, according to the Hong Kong Investment Funds Association (HKIFA).

Bond funds took up the lion's share of fund sales in 2012, with gross sales of $34.8 billion during the first 11 months of the year.

In terms of net sales, bond funds attracted $13.6 billion from January to November 2012, which is also at an all-time high, representing a 119 percent increase compared with the same period in 2011.

High yield bond funds came first out of the various bond categories, attracting $4.3 billion net inflows. The European bond funds sector became the only category to see outflows ($53 million) as investors were concerned how the eurozone debt crisis would pan out.

Meanwhile, equity funds sales had lost its momentum despite a relatively strong performance in equity markets last year, especially in the second half. Its share in the industry's total gross sales dropped to 19 percent in 2012 from 84 percent in 2007.

Equity funds registered $9.6 billion gross sales during the first 11 months of 2012, dipping 39 percent year-on-year. Furthermore, they saw net outflows of $1.2 billion, compared with a $572 million net inflow over the same period in 2011.

Asia regional (excluding Japan) funds and Asian single market funds (non Japan/China/Hong Kong) saw the largest outflows, at $318 million and $298 million, respectively; Greater China Equity funds, once the most popular category, saw $279 million net outflows. Hong Kong equity funds managed to attract $34 million, but it is only marginal compared with the total outflows.

Lieven Debruyne, chairman of HKIFA, said the investors were not buying into equity funds last year as they were still alert on issues and uncertainties in Europe, the US and even the Chinese mainland.

"Despite a strong equity market in the second half (of 2012), the conviction of a sustained performance in the equity market is still not there," said Debruyne.

But he said that if the performance of the equity market continues to be strong this year, investors may be interested in equity funds again.

Debruyne said he believes that the fund sales in 2013 will remain at a healthy level on the back of the extended low interest rate environment in Hong Kong, as investors will continue to search for higher yield products to increase their wealth.

Bruno Lee, HKIFA Unit Trust subcommittee chairman, warns that investors should be aware of the potential risks associated with bond funds.

In particular, any bonds or bond funds will be subject to credit risk of the issuer, interest rate risk and currency risk as well as the change in the economic environment.

Also, for funds that have regular pay out, investors should understand whether the distributions are generated from income from the portfolio only or from the fund capital as well, said Lee.

sophiehe@chinadailyhk.com

(HK Edition 01/09/2013 page2)