Jewelry retains glitter appeal

|

A model trying on a gold-decorated necklace in a store in Zhengzhou, the capital city of Henan province. Inflationary pressure and few profitable investment options in property and securities markets stimulated a passion for buying gold and all other kinds of jewelry in the Chinese market. Lang Sha / for China Daily |

Experts predict ongoing robust demand for gold as incomes keep growing

The robust growth of the jewelry market on the Chinese mainland is expected to continue thanks to thriving domestic demand and a larger disposable income, a report forecast.

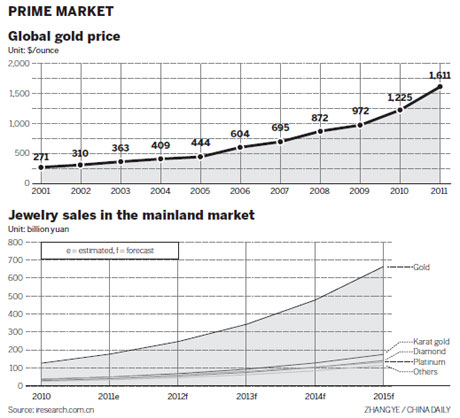

The market could surge by more than 35 percent this year, said Raphael Jiang, an analyst with Frost & Sullivan. He predicted the momentum will continue for the next five years.

Demand is being driven largely by people's higher income and a rising awareness of jewelry as an anti-inflation asset. In addition, retailers' expansion plans in third- and fourth-tier cities and the emergence of a fierce rival in e-commerce have contributed, the report said.

"We are optimistic about the market this year because the first two months saw sound performances," said Winston Chow, director and deputy general manager of Chow Sang Sang Holdings International Ltd, a leading Hong Kong jeweler.

"Once the jewelry market starts growing it is hard to stop its momentum. Every year people get married and give birth," Chow said of the growing awareness of jewelry buying in traditional Chinese culture. Delicate gold, platinum or jade jewelry are popular gifts given by the older generation when celebrating engagements, weddings, baby showers or birthdays.

In 2011, domestic jewelry companies achieved sales of 183.7 billion yuan ($29 billion), with an annual growth rate of 42.1 percent, according to the National Bureau of Statistics. The growth rate is twice as high as that of the total retail sales of other consumer goods. The figure for the latter was only 17.1 percent last year.

The report predicted an annual growth rate of more than 30 percent during the 12th Five-Year Plan period (2011-2015), driven particularly by the rising disposable income of residents in third- and fourth-tier cities.

Although per capita jewelry purchases in China lag far behind developed countries, the growing purchasing power will provide the fundamentals for rapid market growth in the future, the report said.

The report found that retailers in the jewelry industry in first- and second-tier cities such as Beijing and Shanghai are densely distributed with strong penetration by major brands.

Leading brands have expansion plans to reach the smaller cites since the big cities have been saturated. For example, Hong Kong jeweler Chow Tai Fook has more than 1,000 retail points of sale currently on the Chinese mainland. It plans to expand to 2,000 points of sale before 2020.

Chow Sang Sang has a presence mostly in medium- and high-end department stores in about 80 cities in second- and third-tier cities. It is hesitant to enter fourth-tier cities, Chow said.

The report said an increasing number of Chinese people have realized that jewelry is an investment against inflation.

"More and more consumers are attracted by gold jewelry, gold coins and other valuable jewelry," said Jiang of Frost & Sullivan. "The insane growth in the price of gold caused by the unstable global economy especially contributed to people preferring to buy gold jewelry."

The reports also looked at challenges the industry facing - including climbing operating costs for retail enterprises and the difficulties of breaking into the market in third- and fourth-tier cities.

Jiang said the competition caused when distribution channels expand into unsaturated cites will help strengthen the market concentration through eliminating small- and medium-sized players.

According to Frost & Sullivan, there are at least 10,000 retail companies in the Chinese market, of which fewer than 200 have cornered more than 60 percent of total retail revenue.

E-commerce is of rising significance even for traditional retailers, the report said. Both Chow Tai Fook and Chow Sang Sang announced a high-profile entry into Taobao Mall last year, bringing fierce competition and unpredictable outcomes to the mainland jewelry e-commerce industry.

"We've made great efforts in online businesses, although at the moment it only accounts for about 2 to 3 percent of our overall sales," said Chow of Chow Sang Sang.

The brand sets up its online store with shopping websites - a practice they want to keep. "Consumers like visiting a website with multi-brands the same way they want to buy a piece of jewelry by going to a local department store," Chow said.

Leading online diamond sellers Zbird said the coming together of the traditional brands will promote awareness of online shopping and encourage more customers to try the new purchasing method.

Zbird had sales of about 600 million yuan last year, 1.5 times more than those of 2010. The target for this year is 1 billion yuan, said Guo Haifeng, branding manager at Zbird.

Apart from building Internet platforms, the company has set up 12 experience centers in office buildings to interact with potential customers and an investment project that sells diamonds to its 126,000 members for investment purposes, he added.

wangzhuoqiong@chinadaily.com.cn

(China Daily 03/20/2012 page14)