|

|

Emerging markets review Q1 2013 by Thomson Reuters |

The total value of announced M&A activity in the Emerging Markets reached US$128.9 billion during the first three months of 2013, a 5.8% decrease compared to the start of 2012. The number of M&A transactions in the Emerging Markets reached 2,790, a 16.2% decline from the first quarter of 2012.

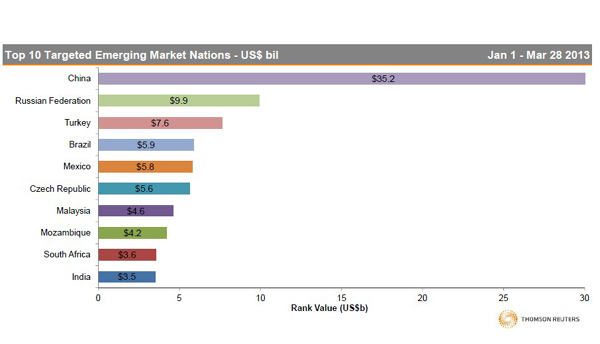

Chinese targets once again drove M&A activity in Emerging Markets, with 679 transactions worth US$35.2 billion. Russian targets, the second most sought-after companies, remained far behind, with 399 deals worth US$9.9 billion. Turkey followed, accumulating US$7.6 billion over 66 transactions.

Energy and Power dominated Emerging Market activity during 2013, accounting for 21% of all M&A volumes and accumulating US$26.3 billion in deal activity. Materials placed second, with US$21.8 billion.

Average EBITDA multiples across the Emerging Markets decreased to 11.8x for the first quarter, ranging from 5.9x in South Africa to 14.7x in India. Bid premia (to 4 weeks prior stock price) averaged 28.7%, a slight increase over the 27.4% averaged during the first quarter of 2012. Materials targets earned the largest average premia paid, at 36.4%.

Source:Thomson Reuters