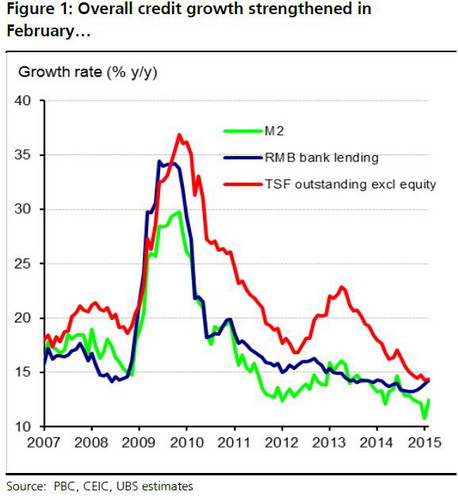

China's February credit growth came in much stronger than expected, as new yuan lending reached 1.02 trillion yuan and total social financing (TSF) rose by 1.35 trillion yuan. As a result, yuan loans outstanding accelerated to a pace of 14.3 percent year-on-year (Figure 1), and TSF (excluding equity finance) growth edged up to 14.4 percent year-on-year in February.

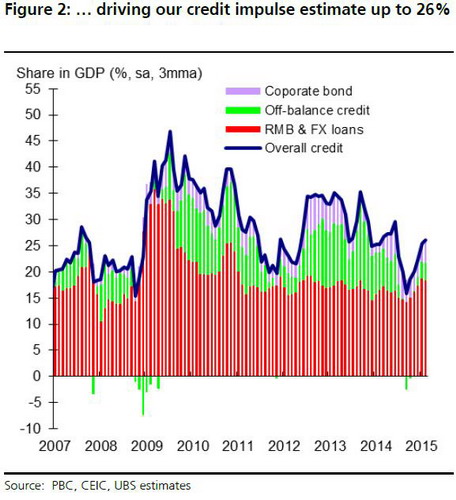

Credit impulse estimate picked up further to just over 26 percent (Figure 2). February's strong RMB loan print is a clear reflection of credit policy easing by the government.

In addition to its recent cutting of the reserve requirement and benchmark interest rate, the central bank has likely increased the yuan loan quota to enable commercial banks to expand lending by a more meaningful margin, to complement its earlier relaxation of banks' other binding constraint?- the loan-to-deposit ratio (LDR).

Although the loan quota and LDRs tend to attract less market attention than RRR and interest rate cuts, they are often the more important tools in China's regulation of new bank credit and loans. We expect 2015's RMB new loan quota to exceed 11 trillion yuan and overall credit growth to stabilize at 13-13.5 percent.

This increase in new credit has likely gone toward the funding of infrastructure investment and replacement of shadow credit. Given January-February's weak corporate investment and simultaneous strong infrastructure investment growth, most of the new credit generated likely went to fund government and related entities' infrastructure spending.

In addition, corporates' bid to survive a worsening cash flow situation may have increased their demand for loans over the past two months.

Finally, as shadow credit growth continues to slow in response to tightening regulations, authorities have likely allowed formal bank lending to expand at a faster pace in order to replace maturing shadow credit, to prevent an overall credit crunch from occurring.

Intensified policy easing can help cushion but unlikely reverse the downtrend in China's real economic growth. As the ongoing property downturn continues to spread its negative impact throughout the economy, further policy easing including fiscal and property policies are needed.

We expect the intensification of policy easing thus far will take time to bear fruit, and may lead to an activity rebound in Q2 and Q3 to help move overall growth closer to this year's 7 percent target.

We maintain our GDP forecast of 6.8 percent for 2015.

This article is co-authored by UBS economists Wang Tao, Donna Kwok and Harrison Hu. The views do not necessarily reflect those of China Daily.