|

|

|

|

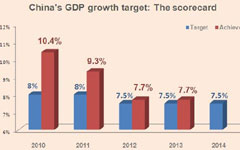

However, the approach to changes in economic policy remains cautious and gradual in several ways. First, growth remains the key objective. The report stresses that "development (that is, growth) remains the key to solving all our country's problems" and that China "must keep economic development as the central task and maintain a proper economic growth rate". Accordingly, the GDP growth target remained unchanged at 7.5 percent.

In the government's terminology, fiscal policy will remain "proactive" and monetary policy "prudent" in 2014, although these labels do not say much about the actual stance. The government's budget aims to keep the official fiscal deficit unchanged at 2.1 percent of GDP. The total fiscal deficit, including the borrowing by local governments from banks and the shadow banking system, is likely to be substantially higher, as it was in recent years, but it is hard to know how high. The report does not contain many specifics on the planned monetary policy stance, other than announcing that the M2 growth target has remained at 13 percent. It stresses the need to "foster a stable monetary and financial environment" and "strengthen macro-prudential management to encourage an appropriate increase of monetary credit and nongovernmental financing."

What does this all mean for the outlook for growth and policy this year? In the fairly benign base scenario of RBS, with sufficient "organic growth", the government can make progress with reining in the pace of the rise in the credit to GDP ratio while protecting its bottom line on growth. In a less benign scenario, with less organic growth, the government is likely to be less forceful on reining in credit growth, given the emphasis on growth. In that case, systemic financial problems or instability remain unlikely any time soon. However, financial risks would rise further and financial market sentiment would remain bearish.

Second, the approach to rebalancing the pattern of growth seems to have evolved, and investment remains the key for the government. Many experts and China's 12th Five Year Plan (5YP) call for a rebalancing of the pattern of growth away from investment and industry towards consumption and services. However, nowadays the government puts the objective somewhat differently. It calls for increasing domestic demand and boosting consumption. But it also wants to "fully leverage … the key role of investment" and says it "will take investment as the key to maintaining stable economic growth."

Third, the government plans a pragmatic approach on how quickly to move in different areas of reform. Even though the government calls for “breaking vested interest”, the report also calls for a "focus on areas where the public call for reform is strongest" and "links on which there is extensive public consensus". Thus, the reform areas that are likely to see significant progress are the ones where there is broad agreement and no strong vested interest resistance. Indeed, looking at the various reform areas, the plans are relatively concrete in areas where there is good agreement and no strong vested interest resistance.

This is especially the case for financial and monetary reform, where the reports' language is quite concrete on the direction – toward a deposit insurance scheme, liberalizing interest rates, expanding the yuan's trading band, and more Renminbi convertibility under the capital account – although there are no indications on timing.