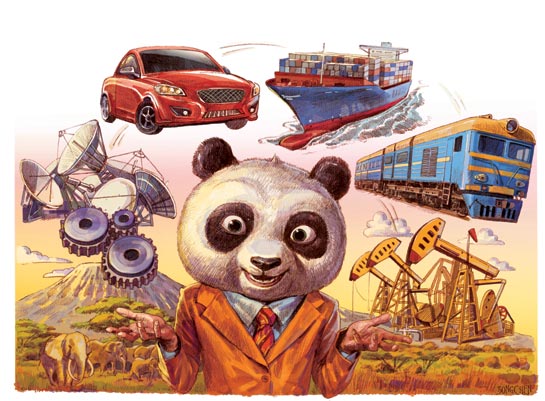

New Frontiers ripe for exploitation

|

|

Enterprises that are State-owned are paving the way for sustainable African development

Zipping through the still-not complete modern expressways that make up the Congo National No 1 Road between Brazzaville, the capital of the Republic of Congo and the port city of Pointe-Noire, it is hard to believe that a Chinese State-owned firm has played a key role in resurrecting what was once a broken-down, abandoned and important transport lifeline in Africa.

Elsewhere in Africa, there is a buzz of activity at the various Special Economic Zones set up by Chinese SOEs in Zambia, Mauritius, Egypt, Ethiopia, Nigeria and Algeria. In Botswana, and Ghana construction projects developed by Chinese SOEs are making a difference by providing more jobs to local communities.

Juxtapose this with the bloated often flabby image of Chinese SOEs and the general perception is that they are behemoths who stifle competition, use up natural resources and hence are a drag on economic growth. The real picture that emerges from Africa, however, is of a new growth model, or rather a success story, built more on sustainable development, community transformation and profits.

"Chinese SOEs have played a key role in the sustainable development of resources in Africa. Through their efforts, the SOEs have been able to make great inroads into the local market and to other developed markets through re-exports," says Shi Yongxiang, a Beijing -based corporate management expert.

Although they are often called China's new pillars of outbound investment, SOEs have also faced flak for pursuing a self-centered agenda, rather than national goals, in overseas markets. But with competent, cost-effective and speedy execution of big-ticket projects in Africa, Chinese SOEs have proved that profits and development can go hand-in-hand.

Speedy and timely executions of big infrastructure projects, along with adequate capital and resources to work even in hostile conditions have been the mainstay of Chinese SOEs in Africa, experts say.

Overseas assets of Chinese companies, running to more than 15,000 units worldwide, are estimated to be worth about $1 trillion and more than half of this comes from SOEs, according to data provided by the State-owned Assets Supervision and Administration Commission.

Liu Nanchang, director of the Performance Evaluation Bureau of the State-owned organization, says that Chinese SOEs will scale up their overseas presence substantially in the next decade. "During the next five to 10 years, we will see SOEs deploying more resources in overseas markets, especially Africa."

Investigations show that the return on investment in Africa is a high 36 percent, compared with 16 and 14 percent in Asia and global markets.

"SOEs find Africa appealing because of the complementary nature of its energy, agriculture and construction sectors," management expert Shi says.

Over the past decade, China's investment in Africa has risen steadily, from $75 million in 2003 to $2.9 billion by 2012. By the end of last year, cumulative investments from China to Africa had reached $19.2 billion, involving more than 2,000 Chinese companies and 51 countries and regions in the continent.