Economy

First quarterly deficit in seven years

By Ding Qingfen (China Daily)

Updated: 2011-04-11 09:07

|

Large Medium Small |

BEIJING - China reported its first quarterly trade deficit in seven years, but analysts said it will not be repeated in the coming months as tighter monetary policies, introduced to combat inflation, slow import growth.

China registered a deficit of $1.02 billion in the first quarter, compared with a surplus of $13.9 billion last year, according to the General Administration of Customs.

This is the first deficit since the first quarter of 2004 when a deficit of $8 billion was reported.

Analysts predicted a trade surplus in the second quarter that will gradually increase during the year, leading to renewed international pressure for currency appreciation.

The deficit was chiefly attributed to efforts to promote imports and the soaring prices of key imported commodities, said Zhang Yansheng, director of the Institute for International Economics Research under the National Development and Reform Commission (NDRC).

"Reduced export growth, due to the rising costs of labor, land and oil, along with yuan appreciation and rising interest rates also contributed (to the deficit)," he added.

China's imports surged by 32.6 percent to $400.66 billion during the first quarter, while exports rose by 26.5 percent to $399.64 billion, customs said.

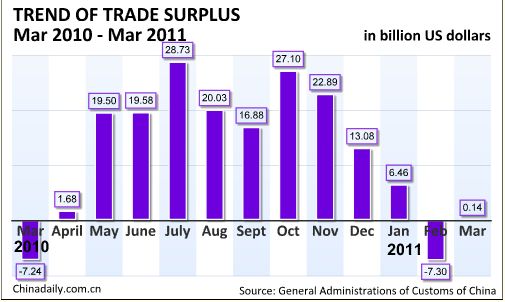

A small surplus of $140 million was reported in March, with exports surging by 35.8 percent and imports by 27.3 percent year-on-year. This contrasted to a monthly deficit of $7.3 billion in February, the first since March 2010.

| ||||

Dong Xian'an, chief economist at Peking First Advisory, said there are two reasons behind the deficit.

"Chinese manufacturers hoarding commodities helped push up prices because of their anticipation of inflation, the Japanese earthquake and the turmoil in some Arab nations," he said.

Dong also cited China's increasing overseas purchases, including high-tech equipment, planes, raw materials, and soybean toward the end of 2010 as another reason.

Iron ore imports grew by 14.4 percent to 180 million tons in the first three months of this year, while the average price rose by 59.5 percent year-on-year. Soybean imports dropped by 0.7 percent to 10.96 million tons, but the average price increased by 25.7 percent.

"The tightening policies will hold back import growth by both volume and value," said senior economist Stephen Green, head of research at Standard Chartered Shanghai.

"The second and third quarters will see trade surpluses. So pressure to appreciate the yuan will remain."

China increased the benchmark one-year lending rate to 6.31 percent on April 6, the second rise this year. The consumer price index, predicted to grow by more than 5 percent in March, is due out on Friday.

A statement released on the government's website at the weekend, citing Premier Wen Jiabao, said China will adopt measures including on the reserve ratio for banks (the amount banks must keep in reserve rather than lend), interest rates and the exchange rate to support the real economy.

Zhou Shijian, senior researcher on China-US relations at Tsinghua University, said the trade surplus will return, as "exports usually see strong growth during the second half" of the year.

"A full-year surplus of around $100 billion is comfortable for China and its economic growth," he said.

The trade surplus dropped to $196 billion in 2009, down from a record $295 billion in 2008. The figure further shrank to $183.1 billion last year.

| 分享按鈕 |