Digital payments enhance travel experience

Around 90 percent of millennials, Gen Z foreign travelers adopt mobile settlements, study finds

As China continues to refine its digital payment service systems, foreign visitors are experiencing unprecedented ease in making cashless transactions across the country.

From seamless QR code transactions to cross-border digital wallet integration, the country's latest innovations are transforming travel — just in time for major international events like the recently concluded 9th Asian Winter Games in Harbin, Heilongjiang province.

With 37 point-of-sale terminals deployed across the event's venues to facilitate seamless payments via foreign bank cards, visitors from outside of China were able to experience firsthand the convenience such technology provides during their time there.

In addition, as a result of the nation's intensified efforts to improve the digital payment experience for international travelers, those visitors can now make payments through two options: one allows them to link their foreign bank cards directly to domestic payment platforms such as Alipay and WeChat Pay, while the other enables them to make payments using their own foreign digital wallets without downloading additional Chinese apps.

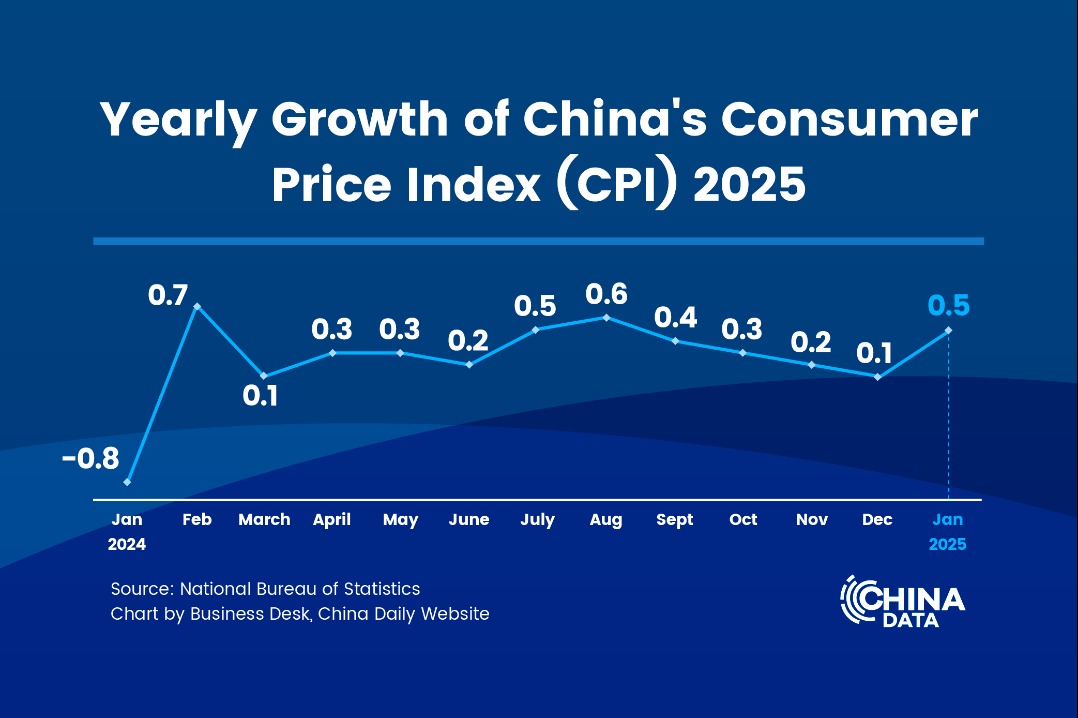

According to local government data, over 860,000 mobile payment transactions were processed for foreign visitors in Heilongjiang between January 2024 and January 2025, marking a 4.9-fold increase year-on-year. The total transaction value exceeded 190 million yuan ($26.16 million) during the same period, up 8.1 times year-on-year, with more than 144,000 foreign users benefiting from these services, a 5.8-fold increase.

"Many foreign visitors are adopting mobile payments, and we as a bank are actively guiding them to experience the convenience of digital platforms like WeChat Pay and Alipay," said a representative from Harbin Bank, adding that based on their observations, most foreign users appreciate the seamless experience very much — whether shopping, dining or commuting — without the need to carry cash or physical bank cards.

"Paying for public transportation via QR codes in mobile apps is incredibly convenient," said Ho Xuan Ni, a Malaysian student at Beijing Foreign Studies University. In contrast to physical transport cards, Ho said digital payments have greatly helped eliminate the need to carry extra cards and constantly check account balances.

A recent study by BFSU on the mobile payment experience of foreign visitors in China found that around 90 percent of millennials and Generation Z foreign travelers adopted mobile payment methods, showing their widespread global popularity. Additionally, about 78 percent of all surveyed visitors reported using mobile payments while in China, with 74.36 percent were already aware of these options before their trips.

"The high pre-travel awareness and actual adoption rates of mobile payments among foreign visitors indicate that China's digital payment ecosystem has to some extent posed a spillover effect on global payment habits, but because of the different payment habits there is still a customary gap for foreign travelers," said Wu Hao, executive director of the Institute of Silk Road Studies of BFSU.

Driven by the evolving travel landscape, an enhanced visa-free policy and the first Chinese New Year since securing its latest UNESCO heritage recognition, China's inbound tourism sector has recently surged like a rising tide, drawing waves of foreign visitors eager to experience the country's rich culture and modern conveniences.

Unlike earlier, visitors can now enjoy digital payment services in more scenarios such as ride-hailing, hotel bookings, attraction tickets, public transport access and tax refunds.

"With the gradual adoption of emerging payment methods in China, such as "tap-and-go", palm print recognition and facial recognition, foreign visitors are expected to experience a wider range of payment innovations in the country," Wu said.

The impact of the improved payment system is reflected in rising transaction volumes. According to data from the People's Bank of China, the country's central bank, during the seven-day Spring Festival holiday (Jan 28 — Feb 3), foreign visitor payment transactions processed by China UnionPay and NetsUnion grew by 127.3 percent in volume and 93.5 percent in value year-on-year, respectively.

Taking a closer look at digital payment platforms, data from fintech major Ant Group also showed that during the first five days of the holiday, foreign tourists' spending via Alipay more than doubled compared to the previous year, while the number of Chinese merchants catering to foreign customers through the platform also doubled. Meanwhile, WeChat Pay reported a 134 percent leap in cross-border transactions during the holiday period as well.