Best way forward for property recovery high on agenda

By analyzing indicators reflecting the latest real estate sector adjustments, experts issued comprehensive judgment on whether fundamentals are strong enough to support China's property market, reversing the downward trend and bringing about stabilization, and endeavoring to recognize major challenges facing the sector's recovery.

Issues addressed include whether the current adjustments in the real estate sector have come to an end; how to achieve stabilization in the property market; and how to strike a balance between new supply and local government fiscal revenue. These are the questions we need to take into consideration when trying to chart a course forward for achieving property market stability.

Logically, the real estate market turnaround should start from the stabilization and rebound of the property sales' growth rate, and the recovery in sales will facilitate price stabilization and then drive up property investment.

Historical data prove such a logic. Since 2005, the growth rate of commercial housing sales by area has been about four months ahead of the price increases of new home sales in the 70 large and medium-sized cities.

Historically, the growth rate of new residential construction moved forward at the same pace as the new home price growth rate, which indicates that the reaction time of real estate developers' new project construction is similar to market price adjustments.

The potential demand strength of China's real estate market could be measured in three parts, which are incremental demand driven by growing urban population, improved living demand in space per capita, as well as depreciation demand associated with aging homes.

By taking the above factors into consideration, China's potential housing demand rose from 980 million square meters in 2002 to a peak of 1.78 billion sq m in 2017, and is going to gradually decline to about 1 billion sq m in 2025, and fall further to 600 million sq m in 2035 and 300 million sq m in 2050. After three years of rapid adjustment, residential sales area stood at 770 million sq m in the first nine months, which is below the potential new demand of 1.04 billion sq m for the full year. Therefore, this round of real estate adjustments has all the markings to stop the falling and achieve stability.

In the above-mentioned estimates, the changing trends of Chinese real estate's potential demand can be evinced. But in reality, growing urbanization, desire for improved lifestyles and housing upgrade trade-ups will impact the changing trends in uneven and sometimes sporadic ways. Factors to impact housing demand include people's income expectations, purchasing power confidence and restrictions posed on homebuying and mortgages.

At present, people's recovering purchase power appetites have become the main supportive factor for stabilizing China's real estate market, especially taking into consideration people's rising savings, and significantly reduced homebuying costs.

Currently, the main hurdle to realizing the stabilization of a falling market is changing household expectations for home prices and take-home incomes. This also indicates that although home prices in China are not excessively prohibitive, to unleash people's homebuying willingness needs support form long-term stable income expectations.

Whether current real estate sector adjustments have come into an end remains a pressing question.

China's property market has undoubtedly experienced drastic adjustments since 2021. As of September of this year, when current supportive measures were not yet introduced, annual housing sales area shrank to half that of 2021, pre-owned home prices dropped 15 percent in China's 70 large and medium-sized cities, real estate development investment fell by about 30 percent from 2021 levels, and the destocking period of generalized home inventories was extended from 21 months of 2021 to 30 months, reaching 2014 levels.

So, are such adjustments adequate? As above analysis has shown, property sales have been below potential demand levels for three consecutive years, people's homebuying capability has improved along with their accumulated savings over the past three years, homebuying costs are 15 percent lower than before, and down payments and mortgage interest rates are also shrinking. As a result, property market stabilization has an objective basis in practical reality.

If effective measures are adopted to overturn market expectations, potential buyers will be encouraged to reenter the housing market. Based on our analysis of major countries' housing price adjustments since 2000, we discovered that many of them have experienced home price adjustments of above 20 percent or even 50 percent. In contrast, the average decline in Chinese mainland home prices is still comparatively mild.

By analyzing the lead-lag relationship between China's home sales and housing prices, we notice that the year-on-year decline of commercial housing sales by area has narrowed since June 2024, which is expected to lead to the narrowing of such declines of home prices beginning in October of this year — though figures will stay in the negative growth range for some period. According to data released by the National Bureau of Statistics, in October, the year-on-year decline of used home prices in the 70 large and medium-sized cities narrowed by 0.1 percentage point to reach — 8.9 percent, and that of new home prices in first-tier cities narrowed by 0.1 percentage point to — 4.6 percent.

So how to achieve stabilization in the property market?

The starting point for a real estate market rebound would always be sales, be it historic experience, or the relationship between real estate investment capital and sales. Following the spirit of the Political Bureau of the Communist Party of China Central Committee's meeting on Sept 26 — which stressed that efforts will be made to stabilize the property market and reverse its downturn — clear improvement in both new and pre-owned home sales area was evident.

In addition to the existing measures, including lowering down payments and cutting home mortgage interest rates, more efforts with regards to stabilizing the economy, employment and expectations are needed to further undergird the improved property sales trend. Real estate is overwhelmingly the chief asset of Chinese families. Therefore stable home prices matter to the health of Chinese households' balance sheets, and is part of future lifestyle expectations of Chinese families with home ownership. This will also further impact people's consumption tendencies. Therefore, as we are at this stage of turning existing homebuying wishfulness into homebuying willingness, stable income expectations are especially needed during the formation of a benign circle in the real estate market.

So how can we strike a balance between new supply and local government fiscal revenue?

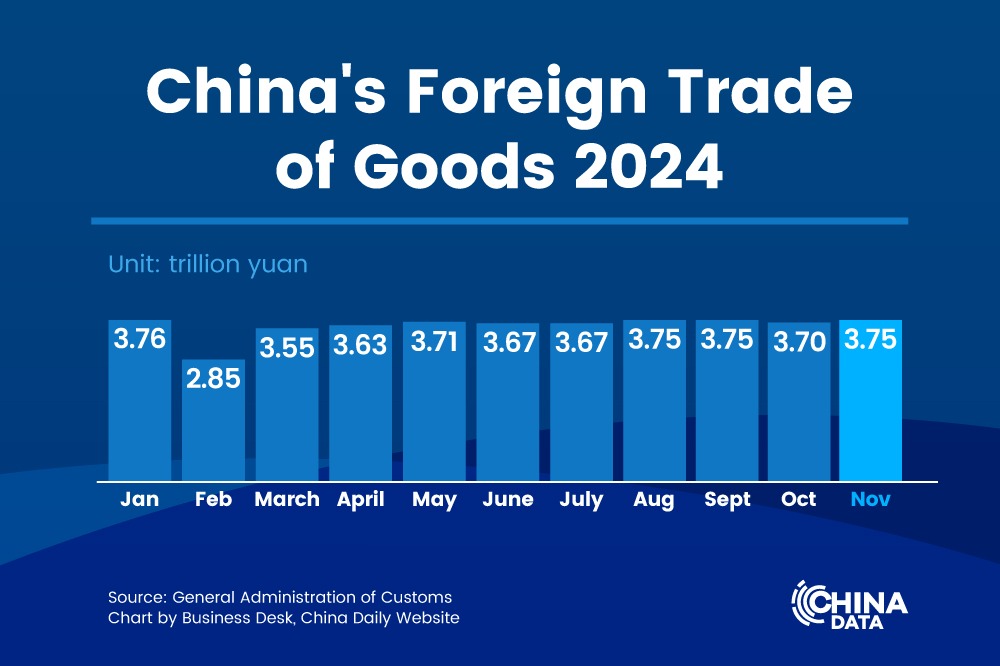

The latest real estate adjustments have greatly impacted local government fiscal revenue. As much as 8.7 trillion yuan ($1.2 trillion) was generated in local land transfer revenue in 2021, and the 2024 full year amount is projected to be nearly halved to 4.4 trillion yuan.

The previous local land transfer revenue is no longer sustainable in the mid to long-term, therefore, local governments need to exploit new sources for their local fiscal revenue.

This is because China's real estate market is gradually entering into a new era of having more existing homes being traded than the transaction volume of newly built homes. In the meantime, local land transfers may potentially raise land and home prices. Furthermore, existing land supply has already presented huge stocks of undeveloped land.

The focus should be placed on destocking property inventories over the short term. We suggest the introduction of multiple measures to activate real estate sales, and encourage property developers to launch projects and acquire land. Proactive market activities will help to promote local land transfer recovery, therefore striking a balance between new supply and local government fiscal revenue.

Zhong Zhengsheng is chief economist with Ping An Securities, and Zhang Lu is a senior analyst with Ping An Securities.

The views do not necessarily reflect those of China Daily.