Conference aims to boost consumption

Much-anticipated meeting to chart course for 2025 economic performance

The upcoming Central Economic Work Conference is expected to strengthen the focus on bolstering domestic consumer demand, a rising policy priority given potential US tariffs and the country's reform ambitions to improve its market economy system, said economists and analysts.

The much-anticipated meeting to chart the course for the Chinese economy in 2025 may imply additional consumption stimulus measures, they said, including expanded trade-in deals for consumer goods and income subsidies for targeted groups, which could possibly add up to over 1 trillion yuan ($138 billion).

Shan Hui, Goldman Sachs' chief China economist, said that the Central Economic Work Conference is likely to see incremental policy support for 2025, with recent dynamics having indicated greater policy emphasis on boosting consumption, which requires stabilization in people's income growth to realize.

Therefore, besides expanding trade-in deals for consumer goods, Shan said China may provide income subsidies for second-child families, increase rural-area pensions and enrich unemployment insurance safety nets, which would be "very helpful in boosting people's confidence and spending willingness".

Her comments echoed vows by Han Wenxiu, executive deputy director of the Office of the Central Committee for Financial and Economic Affairs, to accelerate efforts to nurture a "complete system of domestic demand" and better secure people's livelihoods, as part of the country's top tasks to build a high-standard socialist market economy system.

In an article in Study Times, Han pledged on Wednesday to establish a system to effectively increase incomes among low-income groups, steadily expand the middle-income group and reasonably regulate excessively high incomes.

Han urged efforts to improve mechanisms to resolve structural employment issues, perfect the national coordination of basic pension insurance and enhance social protection for flexible employees, such as migrant workers and those in new forms of employment.

Shan said the pro-consumption measures might be implemented in a gradual and sustained manner to ensure maximized effects, instead of one-off payments like those seen in Europe and the United States in emergencies.

"By raising rural pensions each month per person, for instance, one would receive the money every month, giving him or her the confidence to spend it, rather than saving it out of fear that the support might not continue."

Shan added that her team estimates sizable subsidies for second-child families and increased unemployment insurance.

"To truly boost confidence, the total stimulus for consumption should exceed 1 trillion yuan."

Robin Xing, chief China economist at Morgan Stanley, said that the Central Economic Work Conference, expected to be held in mid-December, may give more guidance on the possible size and mix of fiscal policy for 2025.

While past experience suggests that the specific stimulus size and mix would only be disclosed by the two sessions next March, Chinese policymakers' increased focus on guiding capital market expectations means a rising likelihood of clearer forward guidance early next year.

Xing said the upcoming stimulus for 2025 may be of "moderate intensity" with 2-3 trillion yuan in a fiscal package to support infrastructure investment, government expenditure, housing inventory buybacks, consumer goods trade-in programs and modest social welfare spending.

"The package will include some consumption-oriented measures, but their proportion might not be significant. More stimulus may still be directed toward infrastructure, real estate and other sectors."

China has stepped up efforts to boost consumption by adding 150 billion yuan from ultra-long term special treasury bonds to support trade-in deals of consumer goods this year, with the National Development and Reform Commission having said on Tuesday it would continue to make this policy beneficial to the public.

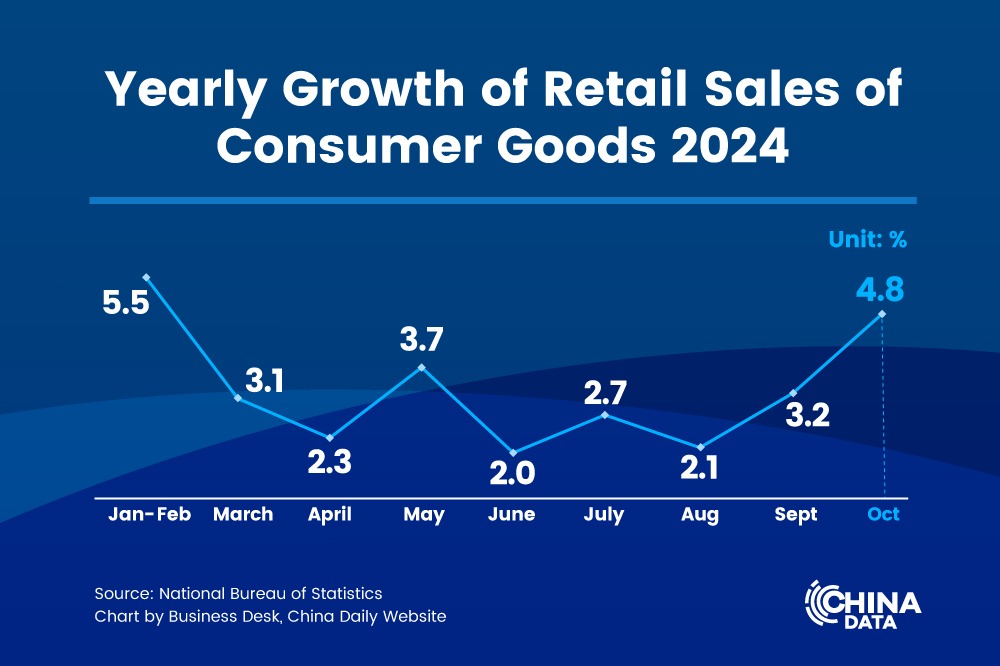

The country's retail sales rose 4.8 percent year-on-year in October, 1.6 percentage points higher than the month earlier, as sales of home appliances, furniture and autos accelerated.

"This suggests that the government is indeed prioritizing domestic consumer demand, an approach different than in the past," said Xiong Yi, chief China economist at Deutsche Bank.

Contact the writers at zhoulanxv@chinadaily.com.cn

?