Stabilizing growth tops national agenda

Maintaining fiscal health, managing property woes seen as key objectives

Securing stable economic growth while maintaining fiscal viability lies at the core of China's pursuit of national security amid intensified external uncertainties and a lingering real estate downturn, leading economists said.

To achieve these goals, they suggested taking decisive measures such as strengthening medium-term fiscal planning, optimizing supervision over local government debt, replacing local government debt with longer-term treasury bonds and establishing a central government-financed institution to acquire idle housing stock.

They made the remarks at a recent forum as the markets eagerly await China's next steps to revive the economy on the fiscal front. The forum, held by the Central University of Finance and Economics in Beijing, was themed around coordination of development and security, focusing on the areas of public finance, financial system, public governance and supply chains.

"Fiscal safety is closely interconnected and inseparable with security in economic and financial areas," said Ma Haitao, president of CUFE and a senior expert, stressing that a robust fiscal system is the last defense against various economic and financial risks.

Ma said fiscal safety refers to ensuring steady fiscal revenue and expenditure over the short term, achieving cross-annual and cross-cyclical fiscal balance in the medium and long term, along with reserving adequate space and resources to resist any potential shocks, including natural disasters, political incidents as well as other economic and social hazards.

Ma cautioned that China's fiscal security is now facing challenges such as slowing fiscal revenue growth, rising local government debt and an aging population, while the debt balance of local governments had nearly doubled from 2019 to 2023, leading to rising debt servicing costs.

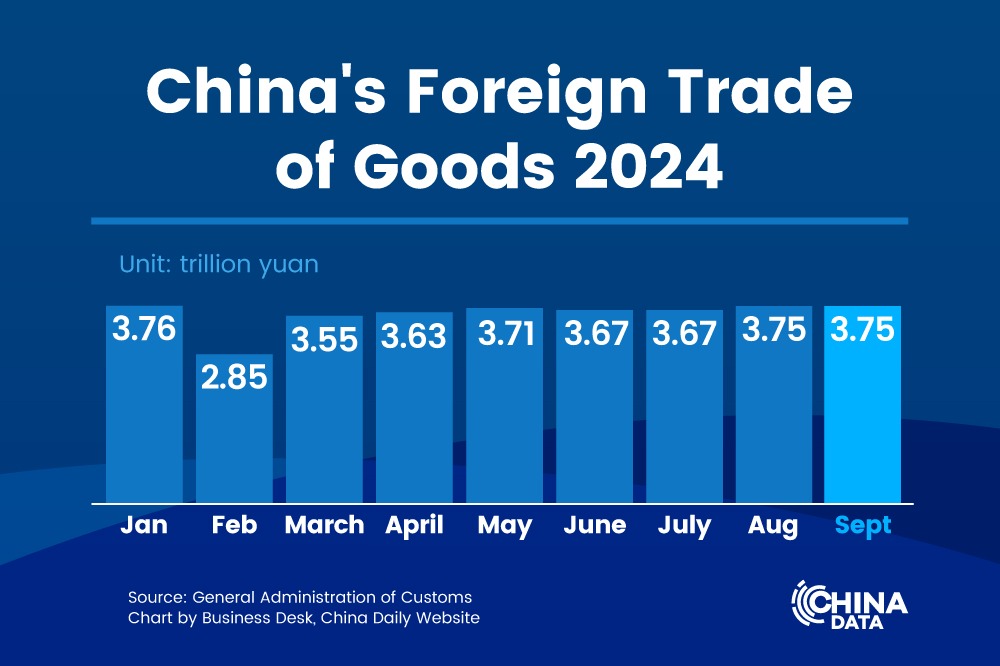

Official data showed that from January to August, the country's general public budget revenue decreased by 2.6 percent year-on-year.

"It's important to strengthen medium-term fiscal planning to achieve fiscal balance across years and economic cycles," Ma said. It is a crucial transformation that can help correct any misalignment between the country's economic and social five-year plans and fiscal planning.

Establishing a long-term mechanism of government debt management also holds the key, said Ma, who urged to intensify supervision by the National People's Congress, the country's top legislature, over local governments' debt budget and management, to avoid any excessive project construction that adds to debt.

Speaking at the forum, Li Daokui, director of Tsinghua University's Academic Center for Chinese Economic Practice and Thinking, also said it is imperative to address the situation that local governments face extremely tight cash flows while banks are flush with liquidity.

"Failure to resolve this issue will impact people's sense of gain, as well as political and social stability," Li said, stressing that the key to social and political stability lies in forestalling drastic macroeconomic fluctuations.

Affected by infrastructure and real estate cycles, Li said China's macroeconomy now faces downside risks. To ensure economic security, an essential step would be a large-scale issuance of treasury bonds to replace local government debt, thus easing cash flow pressure on local governments.

On Saturday, the Ministry of Finance said it plans to increase the debt limit by a large scale all at once and replace the hidden debts of local governments, without disclosing the specific size of the plan.

Li said that a significant portion of local debt, at least equivalent to 20 percent of the country's GDP or around 30 trillion yuan ($4.25 trillion), should be replaced with longer-term treasury bonds.

He added that as benefits of construction projects financed by the debt will last for years, the burden of debt repayment should not be concentrated in a short period.

Echoing Li's remarks, Zhang Ming, deputy director of the Institute of Finance and Banking, which is part of the Chinese Academy of Social Sciences, said that local government debt risks can be addressed properly if the central government is willing to offer help, given the robustness of the central government's balance sheet.

Instead, the most prominent risk to be resolved would be real estate woes, Zhang said, suggesting establishing a national institution — financed by special treasury bonds — to manage the acquisition of idle commercial housing in smaller cities.

Zhang outlined a plan for the institution to purchase housing stock in second and third-tier cities experiencing net population inflows through a tendering process with real estate developers. The acquired properties would then be converted into government-subsidized rental housing.

Yin Mingyue contributed to this story.