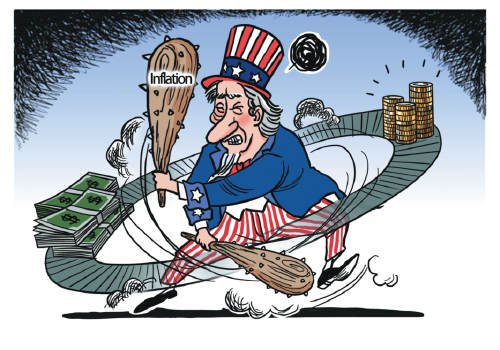

Decoupling will only worsen US inflation

With the last minute passage of the President Joe Biden-proposed "Inflation Reduction Act", Democrats are crowing about how with this imperfect compromise, the United States is going to save the planet from environmental Armageddon. Since the devil is always in the details, scratching beneath the surface reveals a far different picture.

Earlier in my legal career, I practiced truth in advertising law in Washington at the Federal Trade Commission, the US version of a national consumer protection agency, and later managed the team at the ABC Television Network that annually reviewed tens of thousands of advertising claims for their veracity. The legal standard applied then, as now, is the Lanham Act of 1946 and its subsequent amendments.

The Lanham Act's redline that separates acceptable claims from unacceptable, legally actionable ones is whether or not a claim is "false, misleading or deceptive". Although, the IRA is unquestionably a reasonable beginning, its many provisions are full of elements that violate one or more of these prohibitions.

Even the IRA's title is false, misleading and deceptive. Most experts concur that the legislation will have little or no effect on US inflation, and the general consensus is that the reduction, if any, will not be felt for many years. Democrats know that out-of-control inflation, unseen in decades, although not entirely of their making, can easily cost them control of both the House of Representatives and the Senate in the midterm elections in November. This is their desperate effort to apply lipstick on a pig in an attempt to convince voters that happy days are here again with low inflation around the corner.

There's very bad political news though for Biden and his Democratic Party. A nationally projectable Morning Consult poll conducted on Aug 12-14 showed that overall, 57 percent of voters think the IRA will have no impact on inflation, or will increase inflation. And while only 48 percent of Democrats said the IRA would help reduce inflation, a mere 15 percent of independents, whose votes are most important to Democrats' continued control of the Congress, and 6 percent of Republicans said it would.

The IRA does attempt to lower medical costs, shore up the US Treasury and spread the tax burden more equitably. At the bottom it's mostly about the environment, but even there it's found wanting.

Take, for example, the highly touted IRA provision on electric vehicles (EVs) which is supposed to help convert gasoline- and diesel-powered cars into electricity-powered vehicles. A White House brief, "By the Numbers" issued on Aug 15, claims the IRA will provide "up to $7,500 in tax credits for new electric vehicles". That is deceptive and misleading.

In fact, this provision is not so much about the speedy introduction of environmentally friendly vehicles to limit the environmental damage. It's more about separating China from the global supply chains, while preventing competition from and with China.

Prior to 2020, a similar widely used and well-regarded tax credit existed but with fewer strings. It helped millions of US citizens to shift from solely fossil fuel-powered vehicles to electric-based EVs or hybrids.

The IRA has been widely praised for reportedly using "carrots" rather than "sticks". That isn't true either, especially when it comes to China. In place of the expired credit, in order to qualify for IRA tax credits, EV buyers in the US must have an income below a certain level, their EV can't exceed a certain price limit, and must be assembled in North America. Also, no EV made after 2024 can be powered by a battery with critical minerals that the law snidely defines as "extracted, processed, or recycled by a foreign entity of concern." That basically means China because China controls 80 percent of global lithium refining needed to power EV batteries.

Currently, 70 percent of the 72 EV models sold in the US won't qualify for IRA consumer tax credits; after 2024 none would. The IRA's requirements are predicated on the hope that by throwing more money at them, companies of friendly countries will fill the void left by excluding Chinese lithium. This is technically possible, but practically unlikely as it takes three to five years to build on-shore processing equipment and enter into a contract with non-Chinese sources at comparable costs. At best, it's new Cold War thinking.

Some experts think the naive IRA requirements are so burdensome that no EVs will qualify for the benefits till the act expires in 2032.

In the ideal world, the logical answer would not be to reinvent the wheel, but for the US to instead remove the Donald Trump-era tariffs on EVs and other Chinese products, and for China to reciprocate. The US currently imposes a 25 percent tariff on roughly $250 billion of imports from China, including EVs, and a 7.5 percent tariff on about $112 billion worth of Chinese imports. In response, China has imposed roughly comparable tariffs on US goods. It's estimated that the lifting of tariffs on Chinese goods alone could reduce US inflation by 1 percent.

China has many EV companies and of the 6.8 million EVs produced globally last year, 3.5 million were sold in China, compared with just 631,000 in the US. There's no reason, given a level playing field, why the US and other countries can't compete with China, if allowed to do so.

Additionally, the US has literally put the cart before the horse because it doesn't have enough EV charging stations-about 125,000 but many are damaged or not operational. One survey in San Francisco Bay found one in every four chargers was broken. Who would take a chance of being stranded when a typical EV can't go much beyond 300 kilometers per charge? In contrast, China has more than 2 million charging stations that form the largest network in the world.

Germany's first chancellor, Otto von Bismarck, famously said that "politics is the art of the possible, the attainable-the art of the next best". The IRA is a perfect example of an imperfect compromise. But Bismarck's less remembered quote, "If you like laws and sausages, you should never watch either one being made" more accurately describes the IRA, especially at a time when the US system is under extreme stress.

The author is a senior fellow at the Center for China and Globalization. The views don't necessarily represent those of China Daily.

If you have a specific expertise, or would like to share your thought about our stories, then send us your writings at opinion@chinadaily.com.cn, and comment@chinadaily.com.cn.