Renminbi has to tackle US dollar challenge

The continued rise of the renminbi's exchange rate has caught wide attention. Facing the excessively loose monetary policy of the US Federal Reserve, the renminbi is facing both short-term and long-term appreciation pressures. The appreciation of the renminbi is related to the weakening of the US dollar index due to the uncertainties of the US economy featuring weak employment and rising inflation risks.

On the one hand, its export boom gives China more space to tolerate the appreciation of the renminbi's exchange rate. On the other hand, while international commodity prices are rising fast, significantly raising the cost of China's manufacturing industry and putting it under imported inflationary pressure, an appropriate appreciation of the renminbi is conducive to reducing the risk of imported inflation.

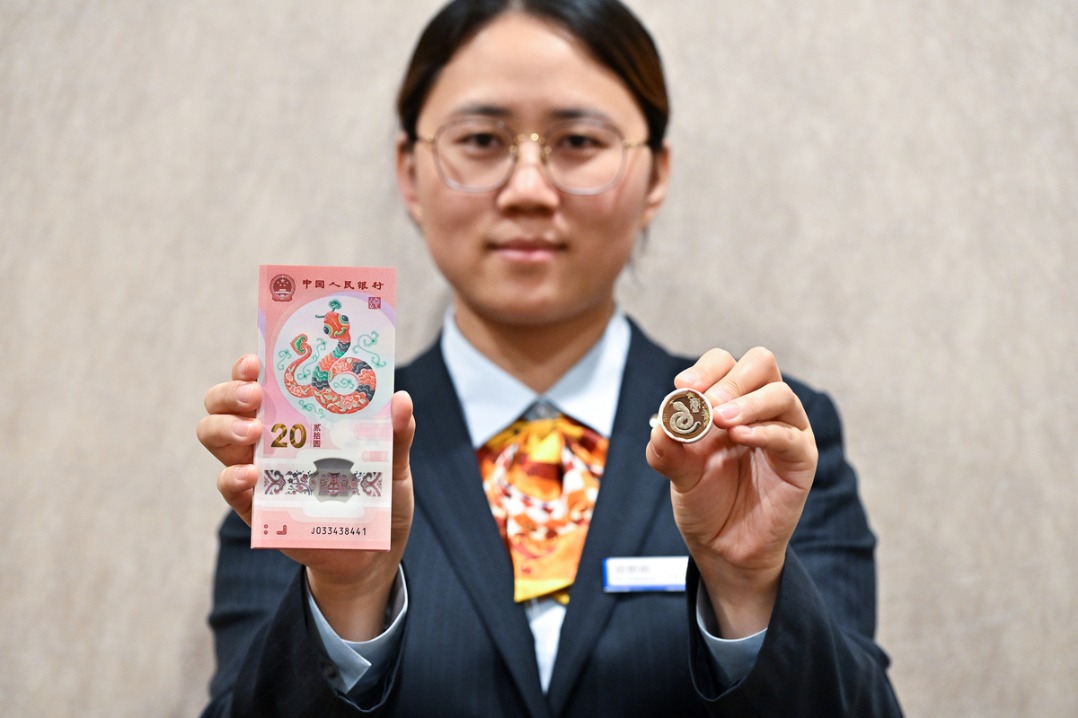

So the rise in the renminbi's exchange rate is basically determined by the market, partially reflecting the strength of the Chinese economy, which will maintain long-term growth, so the renminbi will continue to be a strong currency.

Yet, how to face the long-term and sustained challenge from the US dollar deserves Chinese policymakers' attention. The Federal Reserve's balance sheet has expanded from around $700 billion before the 2008 crisis to more than $7.6 trillion today. According to the projections of Deutsche Bank, the Fed's balance sheet will expand to about $40 trillion by 2050, if its addiction to easy money is unchecked.

The impact of the epidemic has accelerated Fed's printing of banknotes, and as history shows, it will increasingly rely on quantitative easing and the monetization of fiscal deficits to bail out the US economy. That will pose huge challenges to the world's financial system and the global economy, as the US does not care about the responsibility of the dollar as an international reserve currency.

As such, China has to make a strategic choice to escape the dollar trap.

While boosting consumption and innovation, and deepening its market-based exchange rate reforms, China should actively promote the internationalization of the renminbi. Despite the US' destructive trade policies, the renminbi has become increasingly popular in China's trade with its neighbors and trade partners, showing the potential of it as an international currency.